Calculate YOUR Solar Roof Savings

Outline

– Why calculating solar roof savings matters now

– The core formula: from sunlight to dollar savings

– Costs, incentives, and payback math

– Advanced factors: roof, batteries, and billing structures

– Step-by-step worksheet and conclusion

Why Calculating Solar Roof Savings Matters Now

If energy costs feel like the tide, rising and falling without warning, your household budget is the boat. Calculating solar roof savings gives you a chart and compass instead of guesswork. Rather than focusing on panels alone, the real story is how your roof, your local sun exposure, and your utility’s billing rules interact with your usage. This calculation helps you understand whether solar meaningfully shrinks your bill, how quickly it can pay back, and how resilient those savings are under changing rates.

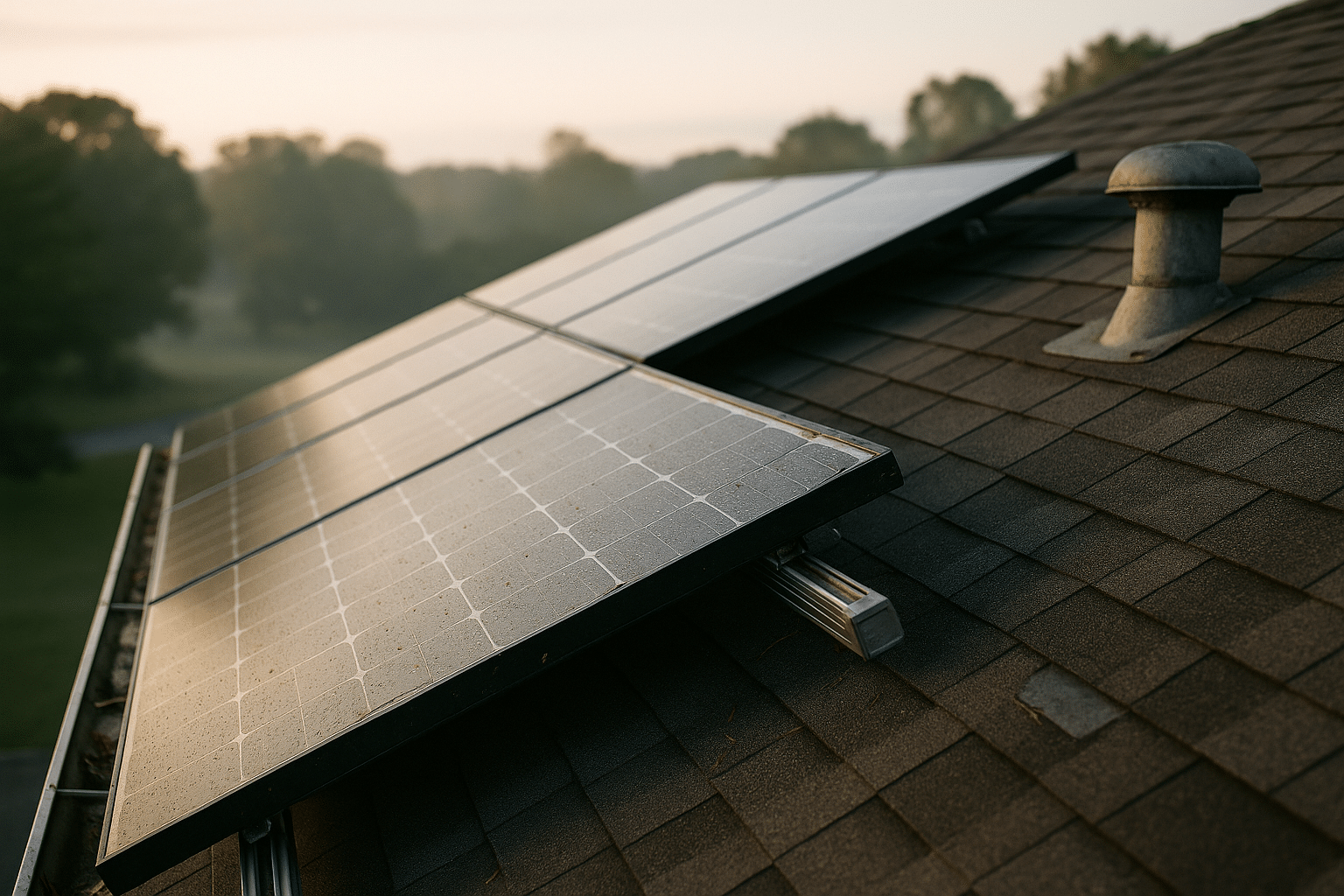

Two realities make this especially relevant. First, retail electricity prices tend to rise over time, driven by fuel costs, grid upgrades, and regional constraints. Even modest annual rate growth compounds over a decade, turning small monthly savings into substantial lifetime value. Second, rooftops differ. A south-facing roof with minimal shade and standard pitch can generate markedly more energy than a complex roof with dormers and nearby trees, even when the panel count appears similar.

A savings calculation also cues up practical decisions. If your roof needs replacement soon, aligning reroofing and solar can avoid duplicate labor and reduce future hassles. If your utility offers time-of-use pricing, you may shift appliances or add a battery to improve daytime self-consumption and capture higher evening rates. If export credits are low, the design may favor right-sizing the system to your typical loads rather than oversizing for exports you’re paid less for.

Here are questions that sharpen your estimate:

– What were your last 12 months of kWh consumption and average $/kWh?

– How sunny is your location across the seasons, and how shaded is your roof?

– What are your utility’s rules for exports, credits, and fixed charges?

– Are there incentives, tax credits, or rebates that reduce upfront cost?

By tackling these questions with a structured method, you convert an abstract idea into numbers you can plan around. The outcome is not only a snapshot of savings today, but a framework to revisit as rates, incentives, and your household needs evolve.

The Core Formula: From Sunlight to Dollar Savings

At the heart of every solar savings estimate is a simple progression: sunlight becomes electricity, and electricity offsets the kWh you would have bought from the grid. The math starts with how much energy your system can produce, then moves to how much of that energy you use on-site versus export, and finally applies your utility’s pricing to translate kWh into dollars.

A practical production estimate uses this structure:

– System size (kW DC) × production factor (kWh per kW per year) = gross annual kWh

– Multiply by (1 − system losses) to account for wiring, inverter, temperature, dust, and shading

– Adjust for year-to-year weather variability and panel degradation over time

Production factors vary widely. In many temperate zones, annual output often ranges roughly 1,100–1,700 kWh per kW installed, depending on latitude, roof orientation/tilt, and shading. A well-oriented 6 kW system in a sunny region might produce near 8,400 kWh per year before losses; the same array in a cloudier climate might land closer to 6,600 kWh before losses. Common losses (inverter efficiency, temperature, wiring, soiling) can sum to 10–18% in typical conditions.

Example calculation

– Roof: Mostly south-facing, moderate pitch, minimal shade

– System size: 6.0 kW

– Production factor: 1,400 kWh/kW/year → 8,400 kWh gross

– Losses: 14% → 8,400 × 0.86 = 7,224 kWh net

– Electricity rate: 0.22 $/kWh

– First-year avoided cost: 7,224 × 0.22 ≈ 1,589 $

Now layer in how your utility pays for exports. If you self-consume 60% and export 40%, and exports earn 0.10 $/kWh while imports cost 0.22 $/kWh, then savings come from:

– Self-consumed energy: 7,224 × 0.60 × 0.22

– Export credits: 7,224 × 0.40 × 0.10

Adding these yields a blended first-year benefit. Two more refinements matter: utility rate escalation and panel degradation. If rates rise 2–3% annually and modules degrade about 0.4–0.7% per year, the lifetime savings curve will generally trend up, though each kWh from the array slowly declines.

Key variables to track

– Azimuth and tilt: South-facing at 25–35 degrees often performs well in mid-latitudes

– Shading: Even partial morning or late-afternoon shade can noticeably trim annual output

– Temperature: Hot roofs reduce instantaneous efficiency; cool, clear days often overperform

– Dirt and snow: Seasonal buildup can create short-term dips

– Inverter topology: Component efficiency and uptime influence net generation

– Usage profile: Daytime loads boost self-consumption and reduce dependence on export credits

This framework cleans up the complexity: start with kWh, then apply your utility’s rules to convert kWh into dollars with realistic assumptions.

Costs, Incentives, and Payback Math

Understanding savings is half of the equation; the other half is what you spend to get there. Residential solar pricing varies by region, labor market, permitting complexity, and roof type. Installed costs commonly land in a range such as 2.50–4.00 $/W before incentives for straightforward pitched roofs; intricate roofs, tile surfaces, or significant structural upgrades can push higher. Soft costs—design, permitting, interconnection, and inspections—also influence totals, even when hardware prices are moderate.

In many countries and regions, incentives can materially change the picture. These may include:

– Income tax credits that reduce net cost based on a percentage of eligible expenses

– Upfront rebates from state or local programs

– Performance payments for each kWh generated

– Sales or property tax exemptions on eligible equipment or added value

As an example scenario, assume a 6 kW system at 3.20 $/W = 19,200 $. If an applicable 30% income tax credit is claimed, the net cost after the credit could be around 13,440 $ (timing and eligibility vary; verify with a qualified professional). Using the earlier first-year avoided cost near 1,589 $ (subject to self-consumption and export rules), the simple payback would be roughly 8.5 years. If your local rate is higher or you can align usage with production, the payback can shorten; if your export credits are low or shade is significant, it can extend.

Financing choices affect cash flow:

– Cash purchase: Highest upfront outlay, no interest costs, full control of incentives where applicable

– Loan: Spreads cost over time; compare interest rate and term to expected annual savings

– Lease or power purchase agreement: Lower upfront expense, but confirm the escalator, term length, and buyout options; review how credits and maintenance are handled

When comparing quotes, normalize your analysis:

– Use cost per watt and projected annual kWh to compute cost per lifetime kWh produced

– Check the production model assumptions (tilt, azimuth, shading, losses)

– Confirm equipment specifications and warranties (module output warranty, inverter coverage)

– Ask about expected maintenance and monitoring access

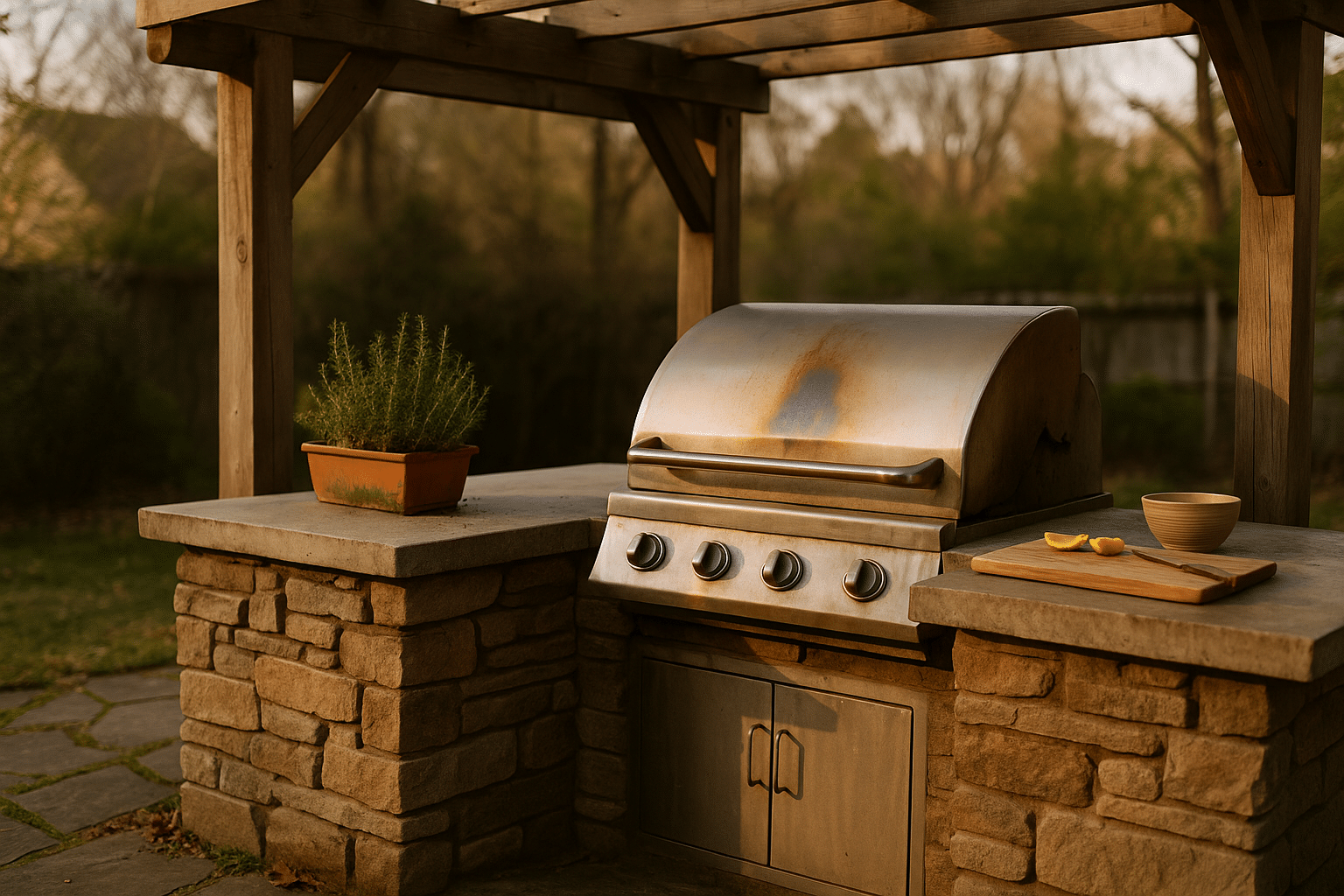

Finally, consider roof timing. If a roof replacement is likely within 5–8 years, bundling reroofing with solar may be more economical than removing and reinstalling later. The net result is not just a payback period; it’s a combined cost-of-energy view that can undercut long-term grid purchases with sensible, transparent assumptions.

Advanced Factors: Roof, Battery, and Billing Structures

Beyond simple payback, several advanced elements can enhance or dampen your savings. Start with the roof. Age, material, and structural integrity all matter. Asphalt shingles nearing end-of-life increase the odds you’ll pay for removal and reinstallation midstream. Conversely, integrating reroofing up front can streamline labor and keep warranties tidy. Flashing quality, penetrations, and wind/snow load considerations also influence longevity and performance continuity.

Batteries change the savings profile by storing daytime surplus for evening use, particularly where time-of-use rates are in play. If off-peak rates are low and peak rates are high, a battery can shift energy to expensive periods, increasing bill reduction without increasing generation. However, batteries add cost and have their own round-trip efficiency losses. The value is strongest when:

– Peak/off-peak price spread is substantial

– Export credits are low relative to retail import prices

– You can pre-charge from solar most days, minimizing grid charging

– Outage protection has meaningful value to your household

Utility rules deserve careful reading. Traditional net metering (credit near retail) can simplify savings. Where exports earn less than retail, maximizing self-consumption is key. Time-of-use structures reward late-afternoon and evening coverage, which can come from west-tilted arrays, demand shifting, or storage. Demand charges (common in some commercial or specialized residential tariffs) may make peak shaving valuable.

Operational tweaks that meaningfully influence savings include:

– Running dishwashers, laundry, and pool pumps during sunny hours

– Pre-cooling or pre-heating within comfort limits before peak rates

– Scheduling water heating and EV charging for solar-rich windows

– Trimming vampire loads and identifying always-on appliances

Site-specific design can also help. If space allows, modest west or southwest orientation can boost late-day production. Module-level power electronics can limit shading penalties from a chimney or vent. Strategic array sizing aimed at your true annual kWh, not just roof capacity, protects financial efficiency when export credits are modest.

Finally, keep an eye on performance. Occasional visual checks for debris, a monitoring portal to confirm daily generation, and a light cleaning if local dust or pollen becomes heavy can maintain expected output. None of these steps is exotic, but together they can make projected savings more reliable year over year.

Step-by-Step Savings Worksheet and Conclusion

Use this quick worksheet to estimate first-year savings, then expand to lifetime value:

Step 1: Gather your data

– Last 12 months of kWh and total dollars billed

– Average or tiered $/kWh, plus any fixed monthly charges

– Roof orientation, tilt, and shade notes

– Local incentives or credits you might qualify for

Step 2: Size the system

– Target a kW size that covers most of your annual kWh without dramatic overproduction

– Example: If you use 9,000 kWh/year and expect 1,400 kWh/kW/year, start near 6.5 kW

Step 3: Estimate production

– Annual gross = system kW × production factor

– Net annual kWh = gross × (1 − losses). If losses are 15%, multiply by 0.85

Step 4: Apply utility rules

– Estimate self-consumption share based on your daytime loads (for many homes, 40–70% is reasonable without batteries)

– Multiply self-consumed kWh by retail $/kWh

– Multiply exported kWh by export credit $/kWh

– Add fixed charges back in; solar rarely offsets them fully

Step 5: Add incentives and compute payback

– Subtract eligible incentives from upfront cost to get a net cost

– Simple payback ≈ net cost ÷ first-year savings (adjust later for rate escalation and degradation)

Two scenario snapshots

– Sunny suburb: 7 kW array, 1,500 kWh/kW/year = 10,500 kWh gross. Losses 14% → 9,030 kWh net. Self-consumption 65% at 0.28 $/kWh, exports 35% at 0.12 $/kWh. First-year benefit ≈ (9,030 × 0.65 × 0.28) + (9,030 × 0.35 × 0.12) ≈ 1,644 + 379 ≈ 2,023 $ (minus fixed charges you still pay).

– Cloudy city: 6 kW array, 1,150 kWh/kW/year = 6,900 kWh gross. Losses 15% → 5,865 kWh net. Self-consumption 55% at 0.22 $/kWh, exports 45% at 0.09 $/kWh. First-year benefit ≈ (5,865 × 0.55 × 0.22) + (5,865 × 0.45 × 0.09) ≈ 710 + 238 ≈ 948 $.

What-if checks

– Rate escalation: Try 2–3% annual increases to see lifetime effects

– Degradation: Apply 0.5%/year to production

– Behavior: Shift 10–20% of flexible loads to daylight to boost self-consumption

Conclusion: Turning Sunshine into a Line Item You Can Trust

Solar savings are not a mystery once you ground them in your roof’s reality, your tariff, and your habits. By gathering a year of bills, sizing for your usage, modeling production with honest losses, and applying your utility’s specific rules, you get a number that means something—and a path to improve it with storage or simple load shifting. For homeowners who value predictable energy costs, a well-analyzed project can provide durable bill relief and resilience. Start with the worksheet above, verify assumptions with a reputable local installer or energy advisor, and let data—not hype—guide the decision.