The Finance Blog

Harriet Montgomery

Every time you apply for a credit card, a loan, or even a mobile phone contract, your credit file may take a small hit. That’s due to something called a hard inquiry — and it’s one of the lesser-known factors that influence your credit score. Many people worry about how credit applications affect their score, Read More

When it comes to building a strong credit score, most people focus on paying bills on time and keeping balances low. These are essential — but there’s another factor that’s often overlooked: your credit mix. Credit scoring models reward borrowers who manage different types of credit. This is where credit diversity comes in. Having a Read More

A good credit score opens doors. It can help you get a loan, rent a flat, or save money on interest. But many people don’t know where to begin. That’s where credit education comes in. The more you know about credit, the more confident you’ll feel. With the right learning resources, you can understand how Read More

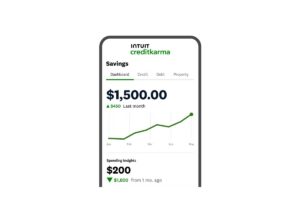

Your credit score matters. It can affect your ability to get a loan, rent a flat, or even secure a job. But building credit doesn’t have to be confusing or difficult — especially with today’s technology. Thanks to financial apps, it’s now easier than ever to track, manage, and improve your credit score. These apps Read More

If you’re just starting out, you might find credit confusing. You haven’t borrowed money before, so you have no credit history. That can make it hard to get approved for loans, credit cards, or even rent. But here’s the good news: you can build credit from scratch. And it’s easier than you might think. In Read More

Building credit can be tricky when you’re starting from scratch. One option many people consider is becoming an authorised user on someone else’s credit card. It sounds simple — and in many cases, it is. But like any credit strategy, it has its advantages and drawbacks. In this article, you’ll learn what it means to Read More

Using credit wisely can open doors to lower interest rates, easier loan approvals, and better financial opportunities. But mismanaging credit can have the opposite effect. This guide explains the steps to master responsible credit use, offers practical strategies for credit improvement, and suggests easy-to-follow financial habits to build a strong credit profile over time. Pro Read More